Buying a new condo is an exciting investment, but it comes with various factors to consider. Whether you’re purchasing a condo for personal use or as an investment, understanding the process can help you make a smart decision. From financing options to location considerations, this guide will walk you through what to expect when buying a new condo.

Understanding the costs of buying a condo

When purchasing a condo, you should be aware of both upfront and ongoing costs. The price of a new condo depends on location, size, and amenities, but additional expenses can impact your budget.

Initial costs to consider

Before finalizing your purchase, you need to account for several upfront expenses, including:

- Down payment: Typically, buyers need at least 5-20% of the condo’s price.

- Closing costs: Legal fees, land transfer tax, and title insurance can add up.

- Deposit structure: Many new condo developments require deposits in stages.

Ongoing expenses for condo ownership

Owning a condo comes with regular expenses, which may include:

- Mortgage payments: Monthly payments based on your loan terms.

- Maintenance fees: Covers building upkeep, security, and shared amenities.

- Property taxes: Varies based on the condo’s assessed value and location.

- Utilities and insurance: Hydro, water, and home insurance are additional costs.

Choosing the right location for your new condo

Location is one of the most important factors when buying a condo. Whether you’re looking for a place to live or an investment property, consider these aspects:

Evaluating the neighborhood

Before making a decision, research:

- Proximity to transit: Easy access to subways, buses, and highways is beneficial.

- Local amenities: Grocery stores, parks, restaurants, and schools add value.

- Future developments: Upcoming projects may impact property values positively or negatively.

Toronto rent vs. Toronto sale market trends

If you’re buying a condo in Toronto, you should analyze current market trends:

- Condo rent prices: Rental demand is high, making condos a good investment.

- Market fluctuations: Prices in the Toronto sale market change based on economic factors.

- Resale potential: A well-located condo will have a better appreciation rate.

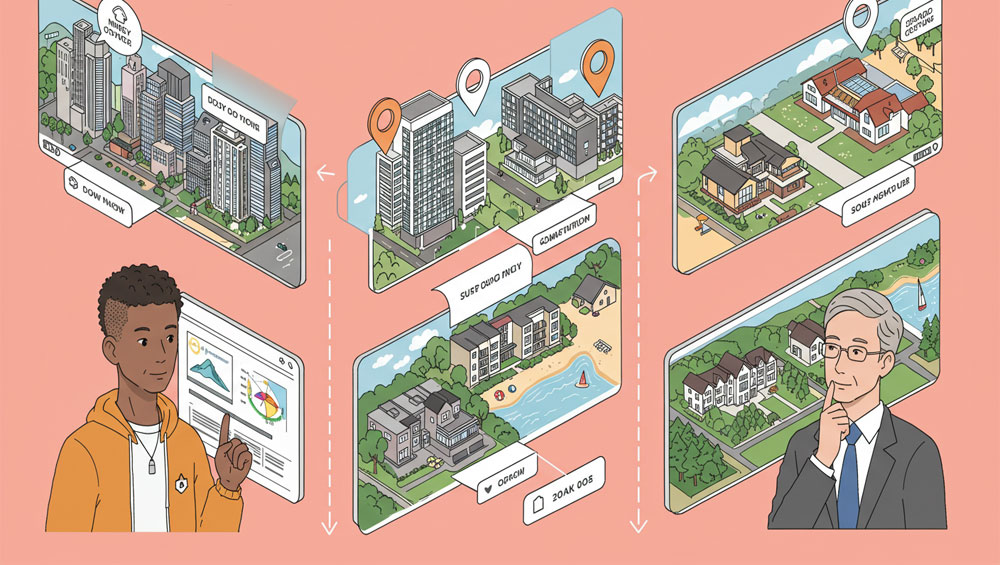

Financing options for buying a condo

Securing financing is a key step in purchasing a new condo. Understanding mortgage options and pre-approval processes will make the buying process smoother.

Getting pre-approved for a mortgage

Mortgage pre-approval helps buyers understand their budget and strengthens their offers. Lenders assess:

- Credit score and income: Determines your eligibility for loans.

- Debt-to-income ratio: Impacts the amount you can borrow.

- Interest rates and terms: Fixed and variable rates affect long-term costs.

Understanding condo mortgage rules

Unlike single-family homes, condos have additional lending requirements:

- Condo fees affect affordability: Lenders consider maintenance fees when approving loans.

- Developer reputation matters: Some lenders may be cautious with certain developers.

- New build mortgages differ: Pre-construction condos often require staged payments.

The buying process

Navigating the condo buying process requires careful planning. Here’s a step-by-step guide:

Working with a real estate agent

A knowledgeable real estate agent can help you:

- Find the right property: Agents have access to exclusive listings.

- Negotiate the best price: They understand market trends and pricing strategies.

- Handle paperwork: Ensures all legal aspects are covered properly.

Reviewing the condo agreement

Before committing, carefully read the condo purchase agreement. Pay attention to:

- Rules and regulations: Check restrictions on renovations, pets, and rentals.

- Fee structure: Understand what your maintenance fees cover.

- Occupancy date: Pre-construction condos may have delayed move-in dates.

Conducting a final inspection

Before closing, inspect the unit to ensure:

- Quality of finishes: Matches the developer’s promised specifications.

- Functionality of appliances: All installations should be in working order.

- Compliance with agreements: Ensure any promised upgrades are completed.

Condo rent vs. buying: making the right decision

If you’re unsure whether to buy or rent a condo in Toronto, consider these factors:

Advantages of buying a condo

Please consider growth, costs and Customization freedom before buying a condo:

- Equity growth: Over time, property values may increase.

- Stable housing costs: Mortgage payments remain more predictable than rent.

- Customization freedom: Owners can renovate their units as desired.

Benefits of renting a condo

We can mention Lower upfront costs, Flexibility to move and Avoiding maintenance responsibilities when renting a condo.

- Lower upfront costs: No need for a down payment or mortgage approval.

- Flexibility to move: Renting allows for easier relocation.

- Avoid maintenance responsibilities: Repairs are usually handled by the landlord.

To sum up

Buying a new condo is an exciting milestone, but it requires careful planning and financial consideration. Understanding the costs, choosing the right location, securing financing, and following the correct buying process will help you make a well-informed decision. Whether you’re looking for a new home or an investment property, staying informed will ensure a successful purchase in the Toronto condo market.